Mar 09 2009

Obama’s Support Is Tanking

Everyone likes to talk about tipping points in politics. Well we may have just hit one with the pork ridden Spendulus bill, followed by the pork laden Omnibus bill, followed by the economic down turn in the markets (if the DOW is a tracking poll, public opinion is heading into the tank).Â

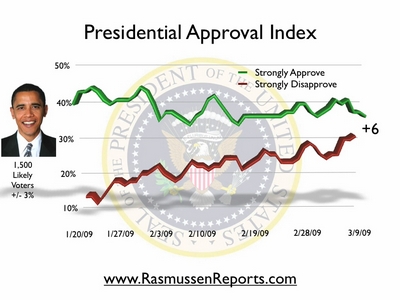

The liberal spend-fest will not turn this economy around. Bailing out banks and home owners who recklessly got into mortgage trouble is not what America wants (they would prefer those who kept their heads above water get bailed out). All indications are America’s mood is souring – and fast. Check out the latest Rassmussen tracking poll on Obama, it shows an interesting trend.

Click image to go to poll page. The Rasmussen poll following the markets into the tank. Obama is rapidly heading towards a one term failure, unless he gets his act together and starts leading instead of being led by the liberals in Congress (who don’t have poll numbers to cheer about either).

Addendum: Rasmussen has a poll up where you can predict what the tracking poll will show on by April 30th (100 days in). For the record I predicted -6%.

Just wait till the collapse of the commercial real estate sector hits us this summer. Once that happens, every pension fund in this country will be insolvent, and the only question will be how long it takes for that news to go public.

Probably as soon as the monthly retirement checks start bouncing.

WWS

There was an MIT econ prof on Bloomberg TV addressing that very subject this morning.

By their models 1/2 the drop is already done and the rest should take stuff to about 2004 levels which some still consider padded in some respects.

WTF, that is not a tanking. That is a collapse. The Stock Market collapse has finally caught up with Obumbler. The investing class knows that the stock market is a forward indicator. It predicts economic conditions six to nine months in the future. The stock market is telling all that Obama’s economic performance so far has been a big fat zero.

The numbers do show that the polarized electorate is still with us. The numbers almost track to the Dem-Rep split of 38-32. I believe the Rasmussen party affiliation poll with show a similar spilt for March. AJ: the phenomenon you described is simply the conservatives and far right getting their bearings straight as Obama has taxed and spent his way to a stock market meltdown. So the President went from a 70-30 approval on Jan 20, to a 60-40 approval after the spendulus bill, to now a 55-45 approval after the omnibus spendarama.

Obama is trying to double down with the cap and trade and the nationalized health care reform. Will the center stay with him after these gigantic far left liberal power grabs or will he sink below a 50% approval rating? That is an open question.

The key to the GOP is the illegal immigration issue as it was in 2005. Someone in the GOP has to face down the hypochondriacs (like Limbaugh) and whip them once and for all. Then the GOP will win back the pro-business voters like Cramer and will keep them if they can finesse the judicial issue.

Obama’s response to problems during the campaign was to give a speach. I understand that he was denied a question from the NYT that he was a socialist. I believe we can look forward to a speach about that very shortly.

I think the issue is health care that the GOP needs to find an answer to. If we don’t find another way to handle health care other then to nationalize it, we are in big trouble as a nation. Look around the world. All countries that have nationalized health care have no national defense to speak of, why, because defense spending always goes to health care. All countries that have nationalized health care ration it. Maybe not at first, but it always happens. A population that accepts less then the best and most innovative anything has a mediocre mind set, that is truly unamerican thinking. And it goes down hill from there. The GOP must come up with something to counter nationalized health care. I am 66, and have medicare. One interesting thing that I learned is that at 65 you have to sign up for medicare, if you don’t you get penalized financially for the time you didn’t sign up. The second interesting thing I learned is that no one would insure me if I didn’t take medicare, because they didn’t have to. So really I had no choice but to be beholden to the government. Of course the government forgets that they are only giving me my money back in the form of medical care. And when the government wants to change the rules, they will.

So please GOP find another answer. Actually I thought John McCain had quite a good idea. Give each family a tax deduction for buying their own medical insurance.

Did anyone else notice these pieces of news this weekend? This first article is about Obama’s position on pork in the budget:

http://www.breitbart.com/article.php?id=D96PSK6O1&show_article=1&catnum=-1

And this one is about fumbling the visit From Great Britian’s Brown:

http://www.telegraph.co.uk/news/worldnews/northamerica/usa/barackobama/4953523/Barack-Obama-too-tired-to-give-proper-welcome-to-Gordon-Brown.html

In. Over. His. Head. And. Above. His. Paygrade.

I’m of two minds about people like the MIT professor and so many other “experts” these days – on the one hand, at least he (and those like him) are aware that the numbers are breaking down and there are some great dislocations looming.

But they fail to see, to be able to see, the point that was made so eloquently in Nicholas Taleb’s book “The Black Swan.” THEIR MODELS ARE USELESS. No one wants to admit that, or even face that, since to do so is to look over the edge and into the pit.

But computer models can only (roughly) compare trends and events to things that have happened before. When an event which Taleb labeled a “Black Swan” occurs, one which has no antecedent in measurable history, then any mathematical model based on previous events becomes useless – in fact, worse than useless because people falsely believe in them and take disastrous actions based on them.

I would put to you that what we are seeing currently – which is *Every* nation and society on planet Earth entering a steep recession simultaneously – is a true Black Swan event, one which was never thought possible, in fact never even concieved of by any financial modeler or forecaster working before the last 6 months. This event, strictly defined, can be called a financial singularity.

Just look at how computer models are behaving in almost every field – in finance, computer risk modeling is what created the financial chaos more than anything else. (Example – look specifically at how Bear Stearns, Lehman, and AIG went so bad so quickly) In the world of climate forecasting – the best computer models in the world predicted that the UK would have a warmer than average winter, and they are finishing one of the coldest winters of the last century. Computer modeling is only valid in a steady state world. But we do not live in such a world.

We live in a world of Black Swans. Much of the time, when things seem ordinary, our world is very similar to a steady state world. But now, to put it in terms of the physical sciences, we have entered into a singularity. No computer model ever written will be able to predict the outcome, because it is impossible to know which equations will apply.

Since true chaos most of the time produces far more destruction than creation, it seems at least likely that we are facing a wave of destruction – destruction of ideas, of assets, of governments – like nothing anyone living has ever seen before.

Eastern Europe should start to fall soon – within 90 days? Possibly. Fall into what? I don’t know. Chaos. Where will this wave of chaos stop? Impossible for me, or you, or any computer model capable of being written to predict. Will it destroy the EU? Possibly. What effect will that have? Unknowable.

worth a read:

http://www.nytimes.com/2009/03/08/opinion/08Ahamed.html?em

I have to wonder about some of these experts. Where have they been for the last decade or so? When the DOW hit a record 14,200 in October 2007 they seemed oblivious to what was coming.

I am not an ideologue when it comes to the government stepping in during an emergency. For instance, during the Savings and Loan crisis government stepped in and the Treasury ended up turning a profit. But they made a point of doing no more than necessary and they made sure the taxpayers were protected.

It seems to me that Obama is using the crisis to expand and enact government policies he would not otherwise be able to pursue. That bothers me.

kathie is right. The GOP needs to come up with some market oriented policies that can create more competition in the health care industry. The costs of drugs and insurance and anything else associated with health care is outrageous. And if we nationalize the industry those costs will not come down, they will simply get passed along to taxpayers. I don’t think people understand that.

And Obama is finding out that being president and running for president are two different things. I hope this time the Democrats actually get to carry some of the load for mistakes they have made..rather than just blaming Bush.

WWS:

I was reading the other day that China was posting a 8% increase in growth. If that is true, then they are not in a steep recession.

And I do not believe we are seeing something like nothing anyone has seen before. In the beginning of the 20th century there was far more chaos than anything we could see here. Look at Russia and the eastern block countries and WW1 all mired in war and destruction at the same time…only to be followed by the worst pandemic in history as well as the Great Depression and then WW2.

I think part of the problem right now is the fear and uncertainty people feel and the effect that has on markets. They used to call recessions “panics” for a reason.

Terry – What you heard is that a Chinese official announced that he was “confident” that their economy would grow 8%. This is not any kind of measurement – this is boosterism of the most transparent kind. It is a ridiculous and transparent lie. Chinese exports are dropping precipitously. The prospect of 8% growth this year is, frankly, ridiculous.

Remember that there are no independant measurements allowed. (Export numbers can be determined independantly) Do you really believe that the Chinese would report any honest numbers with this much on the line? You should remember that any Chinese citizen who states anything contradictory to “official” economic pronouncements is guilty of a crime against the state, and any foreigner who reports such a thing is immediately expelled.

China’s entire economy is geared to the export market. It is logically impossible for them to continue growing when the rest of the world is falling apart.

The “strongly approve” numbers are pretty much flat in trend since early February. What is most interesting is that the number of “strongly disapprove” is pretty close to the total percentage of Republicans being polled. That would tell me that the center is starting to cave. So lets say 33% of respondents identify as Republican and the “Strongly Disapprove”rate is something around 32%. Since I doubt 100% of the Republicans would be “Strongly Disapprove”, the most likely indication to my mind is that Obama is starting to lose support among the “independents” being polled.

Obama won the election by winning a huge portion of the center. Republicans stayed home in record numbers (or didn’t cast a ballot for the Presidential race and only voted other contests) so it wasn’t crossover Republicans that won for Obama, it was winning the middle. If Obama looses the center, any hope he has of reelection is gone. The center is fickle and not beholden to a political party. They aren’t going to vote for someone just because they are the Democrat or Republican nominee. When the independents go to the polls, it is “what have you don’t for me” and “am I better off now than four years ago”.

Obama didn’t get much more turnout than Bush got in ’04. If he loses the center, he is toast. It is the center that decides elections because, like it or not, neither party has enough to win by themselves if all groups turn out equally.

“what have you don’t for meâ€

Meant, of course, “what have you done for me”

WWS a thoughtful analysis.

What would it take to turn everything around? In my opinion, it’s simple. The US has to do something to ‘restore’ confidence and Obama is the key to that. Unfortunately I don’t think the key fits the lock. I think he has already bumbled into the path he wanted all along and in addition to him probably not ‘wanting’ to change it, I actually think his intent is to make it much worse. If it is, he’s going to be successful at failure.

WWS—the Black Swan is a good example of how limiting predictions can be. I like to compare this to hurricane forecasting which always has that cone of uncertainty in spite of similar weather patterns (and names)—you really can’t predict where it will hit and how bad it will be or the resulting actions or inactions.

The 60 year cycle or Kondratiev wave is proving of use in analysis as to where we are and where we are headed.

A Turning Tide?

Obama still has the approval of the people, but the establishment is beginning to mumble that the president may not have what it takes.

http://www.newsweek.com/id/188565