May 03 2009

Economic Pain Increasing, No Help In Sight

Too many people on the right are diverted by irrelevant topics and dramas, missing the Achilles’ Heel of Obama and the liberal democrats: the endless economic carnage playing out before us.The mistake Obama made when he came into office was buying into the liberal myth that the government was an equal or greater partner in economic success when compared to the free market forces of individual and corporation initiative and drive.

Individuals and corporations exist in numbers that dwarf the cautious and constraint thinking bureaucrats and represent the path to economic growth. Government agencies are filled with rules, processes, committees – and the evil concept  of ‘consensus’ – which are designed to stop innovation, tamp down risk taking, remove individual drive by co-opting innovation for the greater good. Tenure stands above success and progress. Government is the anthesis of vibrant growth right down to its cultural core.

Despite this, Obama and the Dems went with an economic recovery plan that relied heavily on this bumbling, ponderous behemoth that stomps out ‘change’ in order to create positive economic change. Their plan to end the economic suffering was to rely on the one thing that could least handle the challenge. It was a naive mistake at best.

This month (next friday to be exact) we’re going to see another round of horrible unemployment numbers:

The April unemployment rate is likely to reach 8.9%, though data this week suggested the pace of layoffs is slowing.

The liberal media attempt to soften the blow by claiming the layoff data is not rising as fast as before is wishful thinking. As is the attempt to spin a reduction in jobless claims into a ray of sunshine:

Consumers cut their spending in March as incomes declined, but a drop in new jobless claims offered hope that the labor market’s deterioration may be slowing.

Consumer spending, which accounts for more than two-thirds of U.S. economic activity, declined 0.2% from the prior month, the Commerce Department said Thursday. Personal income fell 0.3% in March — the fifth decline in six months — though after-tax income was flat.

…

Initial jobless claims fell 14,000 to 631,000 in the week ended April 25, the Labor Department said. The four-week average, which is used to smooth volatility in the data, dropped by 10,750 to 637,250

Those jobless claim numbers are not very inspiring. If you do the math the weekly reduction was a wimpy  2%, well within the margin of error for measuring such national indicators.

While some people look at these marginal numbers to try and see signs of recovery, at best they simply show a slowdown in the downturn. But they do not signal a stopping of the downturn. And they surely do not indicate any sign of things getting better. In fact, there is a lot of data to show that we are not done heading towards the bottom.

First, the international numbers do not look good. Germany and Japan are experiencing historic unemployment as well, so that means the European and Asian markets continue to shrink. It is hard to see opportunities for growth in America if the world economy is shrinking.

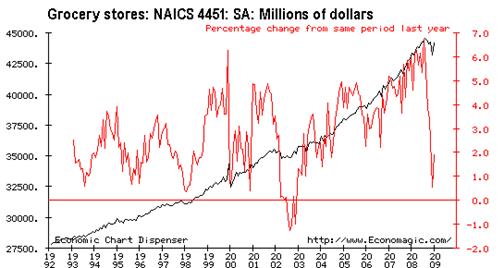

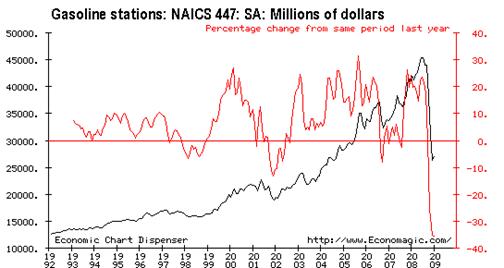

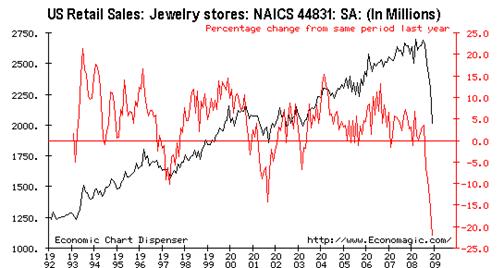

Secondly, if you look at the market indicators inside America, they look horrible. Here is a sample (black is total amount, red is percent change):

Not surprising, grocery stores are seeing the smallest drop off – people have to eat. But consumer spending is still dropping at historic levels, which means jobs are still drying up.

Even at a national 8.5% unemployment rate (March 2009), the spread of real high unemployment is stunning, and is pounding the democratic strongholds of America’s cities:

Unemployment rates in 109 metropolitan areas reached 10% or higher in March, almost eight times more than a year earlier, according to a government report released Wednesday.

Just 14 cities reported jobless rates of at least 10% last year, the Labor Department said.

…

Jobless rates of at least 15% were reported in March in 18 areas

You can read some of the personal tragedies of this economic downturn here, it is a humbling experience. I suspect we will see more and more of these kinds of stories describing the human carnage of the failed Democrat policies throughout the summer.

Because along with this gloomy economic data there is another bit of hard information I can provide. I have been tracking the progress of the stimulus bill’s supposedly ‘shovel ready‘ programs for weeks now. And as I predicted, the money to pay for new jobs doing make-work for the federal government is firmly jammed inside the bloated federal bureaucracy.

Below is the most recent graph (click to enlarge), showing the money authorized to spend in the left hand column for 4 departments and one agency (which combined account for one third of the stimulus bill projects). In addition, the Departments of Energy and Transportation were the economic recovery ‘tip of the spear’ so to speak, representing the major thrust of the economic recovery spending.Â

In the right hand column is the amount of money going into the economy – it is still not visible on the charts. The total percentage of money being spent verses authorized is a paltry 0.03%. The previous charts are here and here. So far, those spears are still being defined and built, none are hitting the economy. I doubt we will see them coming out in any real manner until the fall at the earliest. Which means Obama and them Dems are going to suffer through months of frustration as their liberal fantasies crash into hard reality.

Unlike the days of FDR, when we still had a reasonably svelte and nimble federal government, today’s bloated behemoth is like a terminally obese person trying to get up and run a few laps to get back into shape. It was never going to be able to move fast enough to help the job market. It was never going to be able to ‘stimulate’ anything – its too damn lethargic.

Those 100’s of billions of dollars now stuck in the federal bureaucracy would have been pulsing through the economy and creating jobs right now if the liberals had gone with the tried and true tax cut approach to stimulate economic growth. We might still have had a drop off of jobs in March, but April and May would probably be showing signs of the free markets using those tax cuts to adapt to the economic downturn.Â

Conservatism flamed out in the last few years as it ran out of common ground with most Americans. Liberalism is going to run afoul of main street as well as its government run economic fantasies come crashing back to earth. We really need to stop swinging the pendulum from fringe to fringe and let common sense and pragmatism of the center guide this nation forward.

AJ,

Obama and the Dems use of government spending in the guise of an economic recovery plan, was a red herring. No “naive mistake” here. It was simply a golden opportunity to cram down our throats their liberal social agenda. Social engineering to remake America. “Never let a crisis go to waste” compliments of Rom Emmanuel.

Excellent analysis to prove the foregone conclusion that America elected the most unqualified person in its history. He possesses neither the intelligence to understand the economy (as his socialistic thinking precludes him from such) nor the intestinal fortitude to do what is right (as his cult of personality is more important than the long term best interests of the American way of life—-again because he doesn’t subscribe to the American way of life). He has surrounded himself with some of the most partisan and equally incompetent induhviduals ever to grace the political stage. People who would not have jobs if not for government. Government has never been the place for the best and brightest to shine and this administration will help to enforce that fact which will be remembered next time America is promised the hope of big government to rescue the world.

I would certainly like to know when he plans on capturing Osama as he promised during his messianic crusade. Or is he waiting for the swine flu to get him.

KauaiBoy,

Yep, we got a Class A novice this time. But I also think he believes in the magic of government, which in its current bloated state is really just a memory of the FDR days – which are long gone.

AJ,

Your analysis assumes that had Obama done something different we would somehow be out of this economic mess. This economic recession is universally viewed as the worst recession since the Great Depression and you assumed that we would be seeing signs of recovery in 3 months? Can you cite to any credible economist that predicted on January 21, 2009 that we could turn the economy around or even see a slowing of the decline in 3 months if we made the right moves? I bet you cannot cite a single one.

It is true that much of the stimulus money has not yet produced actual projects, but everyone knew that it would take time when the stimulus bill was passed. Don’t you remember – you and others pointed that out when they were considering passing the bill. The question is not what effect the stimulus will have in the first 3 months, nobody assumed much of it would produce tangible results in that period, the question is what will its impact be in the later half of 2009 when it does start to produce projects. I’m in the development industry and there is already quite a bit of talk about the summer construction projects funded by stimulus money set to begin in the summer/fall. So at a minimum, it is premature to conclude that the stimulus won’t have an affect.

While I’ll applaud you for actually providing an alternative theory on what we should have done, tax cuts are not the answer. Consummer confidence is way down and savings rates are up, which means that people would save, not spend, tax cuts because they are worried about loss of employment and jobs. How would that stuimulate the economy? There is minimal private sector activity primarily because the banks are not lending any money due to their undercapitalization – tax cuts would do nothing to address that problem. The idea of federal spending in a recession, especially one where there is no private sector lending, is to provide some economic activity because the private sector is not producing its usual level of activity as everyone holds on to cash reserves to wait it out. It is a temporary economic measure during a recession, not a permanent shift to socialism.

Yeah Conman,

If the dems had reduced taxes and pledged to keep the Bush tax cuts in place the downturn would not have been as steep and we would probably be recouping.

There were two options, lose revenues or spend money – either way the government was taking on debt. Reducing taxes would have increased innovative business activities, and kept federal revenues higher than they are now. It would have been an immediate pump primer. But now we are losing revenues, as jobs and businesses dry up. And that stimulus money is not moving.

Yeah, it would have been a lot less worse and shorter.