Apr 15 2009

Un-stimulated Economy Is Killing Government Revenues, Adding To Deficits & Debt

Update: Fed confirms my assessment, economy not budging. – end update

As I and many others have noted, the rosy assumptions underlying the Obama and Congressional Democrat’s spending binge to fix the economy are based on very shaky ground. Their assumption is they can spend their way out of this mess (and hence the need for Tea Party protests today).

Today we are getting indications this will never work and we are heading for bankruptcy. First, consumer prices are falling, which in turn means there are fewer taxes being generated (as well as an indicator the consumer is not spending and sustaining the job market):

U.S. consumer prices fell unexpectedly in March and recorded their first annual drop since 1955, government data showed on Wednesday, as slumping demand pushed down energy and food costs.

Slumping demand = more job losses. The ripples are just beginning to spread out as sales tax revenues sink:

State and local sales-tax revenue fell more sharply in the fourth quarter of 2008 than at any time in the past half century, and has continued to erode through the beginning of 2009, according to a report released Tuesday.

Another indication of a shrinking economy is a huge drop off demand for oil and gas:

OPECÂ again revised down its estimate for world crude demand on Wednesday, saying a “devasting contraction” in consumption would keep prices under pressure in the months ahead.

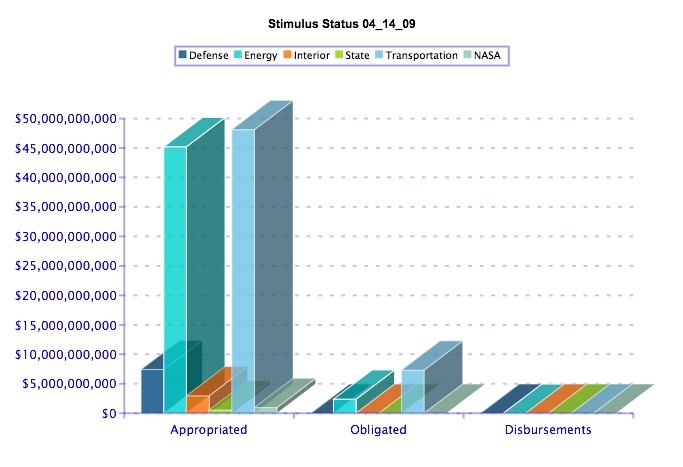

Lower consumption means lower tax revenues at all levels. Â The signals are clear (as we shall see in the state unemployment numbers I hope to post this week). And where is the stimulus money – stuck in the DC bureaucracy, as I noted earlier this month.

The above chart shows that nothing is coming out of DC to create jobs. Nothing. And I expect to see this trend run for months to come.

Foreclosures are beginning to spike up again, in some cases dramatically. This was because a short term decline in forclosures over the last 4 months or so came about not because of any economic improvement, but rather because of a program of “forbearance” instituted by many major banks.

Ruth Simon had a good piece on this in the WSJ which goes into much more detail than I can:

http://online.wsj.com/article/SB123975395670518941.html

Point is, now that the forbearance period is over many of the people who were in trouble are not just 2 or 3 months behind but are now 6 months behind in payments. Those are loans that cannot be saved.

Expect a whole new down cycle in housing as this plays out over the next few months.

There is something REALLY bothering me about all of this. Mind you my minor was in economics. Look this graph of the Adjusted Monetary Base M0 (money controlled by the Fed), and this one of the M1 money supply. See those HUGE spikes?

Normally someone would look at those and say “holy cow, we are in for some serious inflation” because when you dump that kind of liquidity into the system that is generally what happens. Money is like any other commodity, it goes by the rules of supply and demand. When there is a greater supply of money, money gets cheaper (interest rates drop). When capital gets cheap, people generally start using it. Businesses and individuals buy things and as demand for goods goes up, their prices rise. You end up with more dollars chasing goods and services bidding up the prices of those goods and services.

But that isn’t happening. The base went up from about 900 billion to about 1.8 trillion. Lets call it a rise of a trillion bucks. But M1 only went up from, say 1.4 trillion to 1.6 trillion. Lets call that a quarter of a trillion bucks. That says that most of the money isn’t going into the economy. The banks are holding onto it for capital reserves or something.

So it looks like most of the money the Fed has been pouring out is ending up “in bank vaults, plus reserves which commercial banks hold in their accounts with the central bank”

Now when you pour that kind of money into the economy, it should act like gasoline on a fire. The economy should practically explode. Never has that kind of cash ever been poured directly into the economy. But the consumer price index was DOWN for the first time in something like 50 years. Even with all that fuel being poured on, the fire still dimmed.

The economy is simply not supposed to behave that way. That money is supposed to find its way into circulation. For some reason, it seems to be sucked into some kind of a black hole. Where is it going? Why is the economy not taking off with that much cash being flushed into it?

Something about what is going on with this economy isn’t passing a basic smell test. 2+2 is supposed to equal 4, not 3. There is something going on that we are not being told about.

Good question CP – it is odd. Do you mind if I turn your comment into a post?

No, I don’t mind. Having more eyeballs on the subject might reveal something we have not heard about yet.

But we need to keep in mind that the money the Fed is flushing into the economy is going into SOMEONE’s pocket. Someone gets it. The dollars don’t just evaporate. It doesn’t look like the cash is getting into the general economy. Where is it going?